Ipad depreciation calculator

Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. Depreciation asset cost salvage value useful life of asset 2.

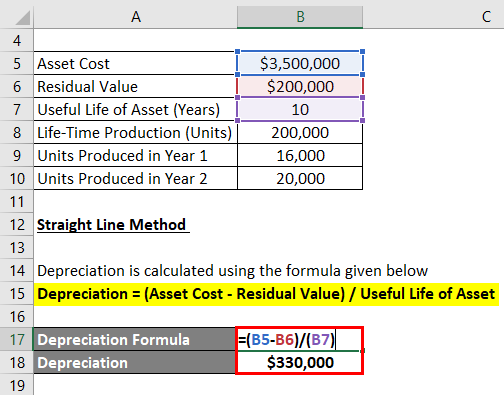

Depreciation Formula Examples With Excel Template

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the.

. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. It provides a couple different methods of depreciation. 6667 per annum on a diminishing value basis.

The calculator also estimates the first year and the total vehicle depreciation. Compare price features and reviews of the software side-by-side to make the best choice for your. We can calculate the accelerated depreciation by the sum of years digits method using this method.

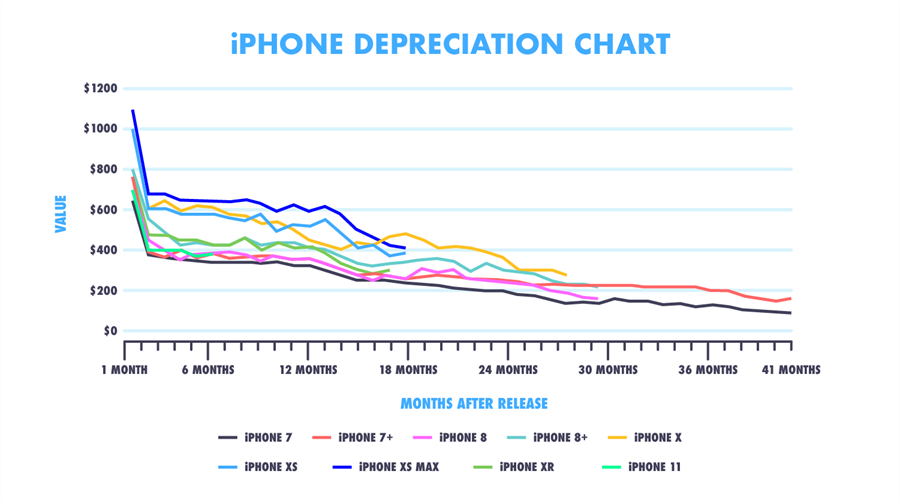

This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used. Fixed Asset Pro using this comparison chart. Check out our Live Smartphone Depreciation Calculator that shows you exactly how much your iPhone has lost in value vs its original purchase price from Apple.

Compare Depreciation Calculator vs. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. IParaV Depreciation Calculator provides various depreciation methods to calculate your assets depreciation schedule.

Double Declining Balance Method. This depreciation calculator is for calculating the depreciation schedule of an asset. The Depreciation Calculator computes the value of an item based its age and replacement value.

Each value that you entered into this. The depreciation rate of a mobile phone based on the Commissioners effective life estimate of 3 years is. You probably know that the value of a vehicle drops.

- Prime Cost - Diminishing Value using Declining Balance and Double. The calculator allows you to use. Just search for your iPhone.

A taxpayer can view liabilities due online real time 247 from anywhere. Depreciation rate finder and calculator You can use this tool to. Extracted by Nashib Umer.

You can browse through general categories of items or begin with a keyword search. The given procedure calculates depreciation expense under the digits. First one can choose the straight line method of.

This calculator allows you to estimate how much your car will be worth after a number of years. Tax calculator calculates the depreciation or amortization of fixed assets. Double Declining Balance Depreciation Calculator Calculate the depreciation for any chosen period and create a double declining balance method depreciation schedule.

You just need to insert the required values of original price depreciation rate and year into the empty boxes of this app and get a detailed solution.

Depreciation Schedule Template For Straight Line And Declining Balance

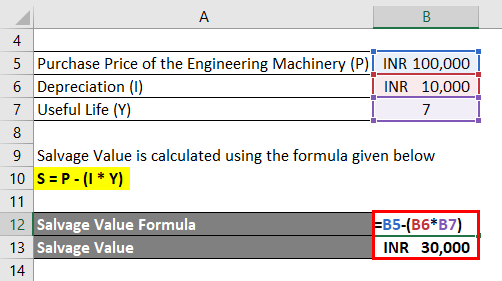

Salvage Value Formula Calculator Excel Template

Salvage Value Formula Calculator Excel Template

Free Boat Loan Calculator For Excel

10 Cash Flow Boosting Facts About Property Depreciation Diy Property Investment Calculator App App Investing

Depreciation Methods Check Formula Factors Types Quickbooks

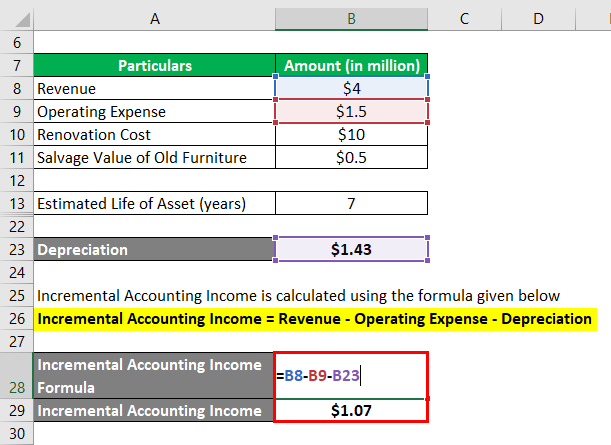

Depreciation Formula Examples With Excel Template

Smartphone Depreciation

Salvage Value Formula Calculator Excel Template

Depreciation Formula Examples With Excel Template

Accounting Rate Of Return Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Salvage Value Formula Calculator Excel Template

Cell Phone Depreciation Has Your Phone Lost Worth Decluttr

Free Macrs Depreciation Calculator For Excel

Smartphone Depreciation